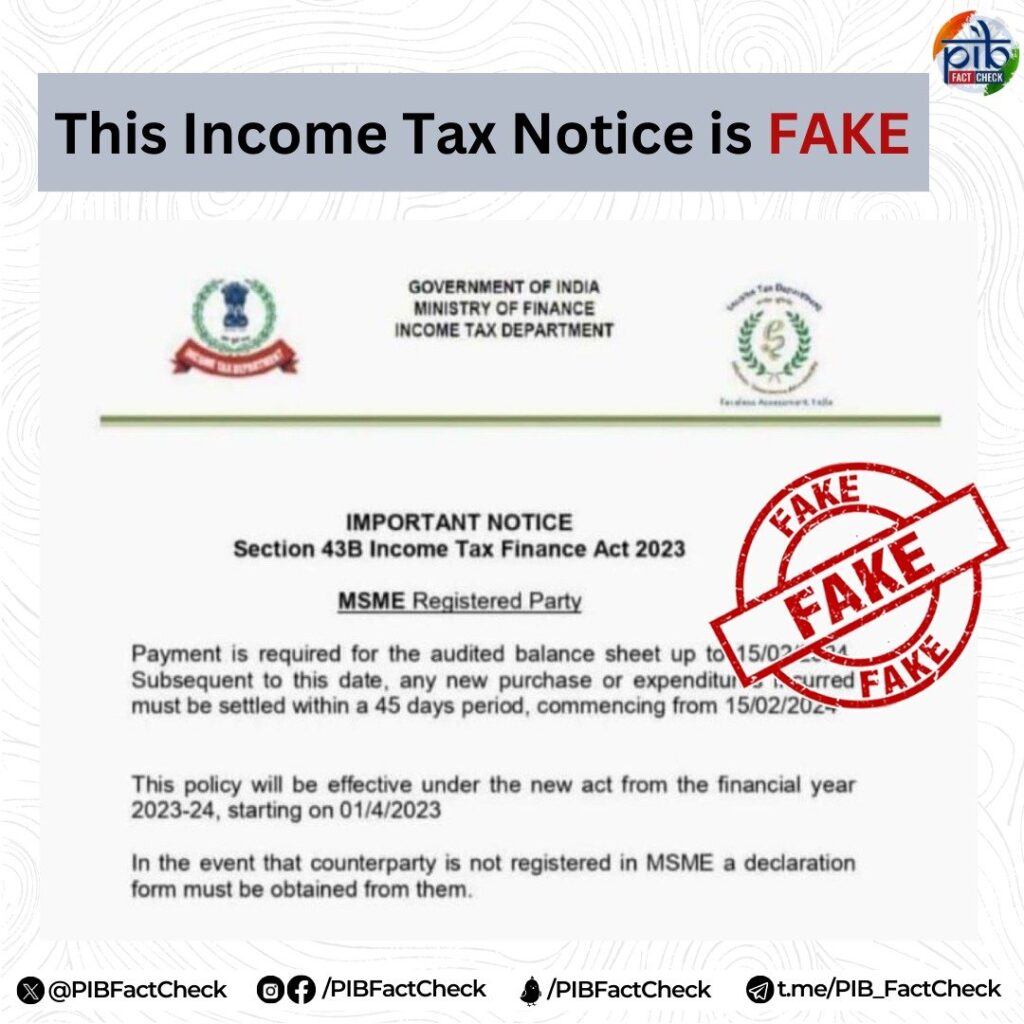

PIB Fact Check: False Income Tax Notice Alleging Payment Obligation for Audited Balance Sheets

A recent tweet by PIB Fact Check debunked a fraudulent notice falsely attributed to @IncomeTaxIndia, asserting a payment requirement for audited balance sheets by February 15, 2024. PIB Fact Check clarified that the Income Tax Department has not issued such a notice and urged individuals to verify notifications on the official website, ‘incometax.gov.in.’ This emphasizes the significance of confirming information through reliable sources to prevent falling victim to misinformation or scams.

A #fake notice issued in name of @IncomeTaxIndia claims that payment is required for audited balance sheet upto 15/02/2024#PIBFactCheck

✔️No such notice has been issued by the IT Department

✔️Verify any suspicious notification on official website – 'https://t.co/P1rZVT5k2P' pic.twitter.com/nXdjCKEFNM

— PIB Fact Check (@PIBFactCheck) February 10, 2024

Source: https://x.com/PIBFactCheck/status/1756365236188360909?s=20