Chandigarh’s GST Collection Expected to Exceed New Target of Rs 2,300 Crore

Based on the current GST collection data, the Union Territory Administration is poised to exceed the adjusted target for the ongoing fiscal year.

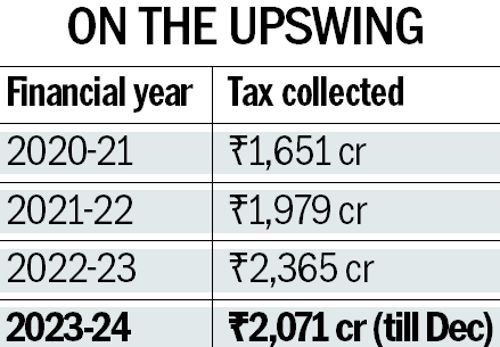

As per the information provided by Union Minister of State for Finance Pankaj Chaudhary in the ongoing Budget session of Parliament, the cumulative GST collection until December of the previous year amounted to Rs 2,071 crore, averaging Rs 230 crore per month. The revised target for the current fiscal year was set at Rs 2,300 crore. Initially, due to concerns about meeting the Budget estimates, the UT Administration had reduced the target by Rs 100 crore in the revised estimates.

Analysts anticipate that the GST collection for the fiscal year 2023-24 will likely exceed the previous financial year’s collection of Rs 2,365 crore. The figures for the fiscal years 2021-22 and 2020-21 were Rs 1,979 crore and Rs 1,651 crore, respectively, as per the information provided by the Minister.

In January 2023, the cumulative GST collection in the city amounted to Rs 234 crore, followed by Rs 188 crore in February, Rs 202 crore in March, Rs 255 crore in April, Rs 259 crore in May, Rs 227 crore in June, Rs 217 crore in July, Rs 192 crore in August, Rs 219 crore in September, Rs 210 crore in October, Rs 210 crore in November, and concluding with Rs 281 crore in December of the same year, as per the information provided by the Minister in Rajya Sabha.

In response to another inquiry in the Lok Sabha, the Minister disclosed that over the past four years, a total of 208 cases of GST evasion had been registered in Chandigarh.

Chaudhary reported that the UT registered 60 cases of GST fraud in the financial year 2020-21, 71 in the fiscal year 2021-22, 47 in the financial year 2022-23, and 30 up to December in the current fiscal.

On the matter of suspected input tax credit (ITC) evasion involving bogus firms, the Minister informed the Rajya Sabha that two such cases were identified in the UT during the quarter ending December last year.

Previously, three instances of GST registration involving the misuse of PAN and Aadhaar details of other individuals to fraudulently claim Input Tax Credit (ITC) were identified in the UT from July 1, 2017, to July 30, 2023. In response, two individuals who had falsely claimed ITC amounting to Rs 10.64 crore were apprehended.